Corporate Governance

Overview

Walsin Lihwa Co., Ltd. (hereafter referred to as Walsin Lihwa) is committed to maintaining its high standard of business ethics, effective accountability, and sound corporate governance in every aspect of business. Such an honest and responsible attitude toward business meets the long-term interest of both Walsin Lihwa and its shareholders, while material information is always timely disclosed to investors and shareholders to maintain high transparency.

Walsin Lihwa believes sound corporate governance is the cornerstone of effective business development to provide high quality products and services while optimizing shareholders’ return on investment. Therefore, a board meeting on June 12, 2019 passed a resolution to establish a Corporate Governance Director position pursuant to Article 23 of the Operation Directions for Compliance with the Establishment of Board of Directors by TWSE Listed Companies and the Board’s Exercise of Powers, i.e., the director shall have been in a managerial position for at least three years in a securities, financial, or futures related institution or a public company handling legal affairs, compliance, internal audit, financial affairs, stock affairs, or corporate governance affairs.

The incumbent Corporate Governance Director of Walsin Lihwa is Vice President Hueiping Lo for her legal qualification for the position. i.e., more than three years of financial director experience at a public company.

The Corporate Governance Director is responsible for board meeting and shareholders meeting arrangements, preparation of board meeting and shareholders meeting minutes, assistance in ongoing education and training for directors of the board, provision of information required for performance of duties by directors of the board, assistance in directors of the board’s compliance with law as well as other matters as prescribed in the Articles of Incorporation of Walsin Lihwa and/or contracts to help strengthen board performance and corporate governance effectiveness.

2024 Corporate Governance Implementation Status

- Board meeting and relevant committee meeting arrangements to facilitate meeting proceedings and strengthen recusal for conflicts of interest

- Provision of information required for performance of duties by directors of the board within the statutory time period to remind them of relevant laws and regulations to be complied with to perform their duties when the board makes a resolution and afterward, and follow through of the progress of how directors’ opinions or suggestions are processed after a meeting

- Amendments to important company bylaws.

- Arrangement of education and training for directors of the board based on company business characteristics, and provision on a regular basis of information on relevant external education and training opportunities to help enable diversified learning mechanisms

- Provision of information required for performance of duties by directors of the board to help streamline their communication with individual business heads, and assistance in independent directors’ communication with the Chief Audit Executive and CPAs to help independent directors effectively perform their duties

- Arrangement of evaluation of board performance and individual function committees’ performance

- Assessment of procurement of suitable directors and officers liability insurance.

- Submission of the international trends of corporate governance as well as latest law and regulation amendments to the board of directors on a regular basis.

- Arrangement of orientation for first-time directors through interviews with the company’s individual unit heads to introduce the company’s operations, relevant job contents, and other matters that should be paid attention to.

Status of corporate governance implementation and board members’ education in 2024

Status of corporate governance implementation and board members’ education in 2023

Status of corporate governance implementation and board members’ education in 2022

Status of corporate governance implementation and board members’ education in 2021

Status of corporate governance implementation and board members’ education in 2020

Status of corporate governance implementation and board members’ education in 2019

Board of Directors

Other current positions: Chairman of Concord Venture Capital Group; Jiangsu Taiwan Trade Mart Development Co., Ltd.; Director of Walton Advanced Engineering, Inc., Ltd., Jincheng Construction Co., Ltd., Walsin Lihwa Holding Co., Ltd., Walsin Specialty Steel Corporation, Walsin (Nanjing) Development Co., Ltd. and Nanjing Walsin Expo Exhibition Ltd.; Vice President and Commissioner of PT. Walsin Lippo Industries and P.T. Walsin Lippo Kabel.

Work Experience: Vice Chairman, President, Walsin Lihwa

Education: Business Administration Department, University of Washington

Other current positions: Chairman of Yantai Walsin Stainless Steel Co., Ltd.

Work Experience: China Steel Corporation President & Acting Chairman of the Board

Education: PhD in Materials Science, National Sun Yat-sen University

Other current positions: Chairman of Winbond Electronics Corporation, Chin-Xin Investment Co., Ltd., Chenghe Investment Co., Ltd.; Director of Walsin Lihwa Corporation, Walsin Technology Corporation, Nuvoton Technology Corporation, Jincheng Construction Co., Ltd., United Industrial Gases Co., Ltd., MiTAC Holdings Corporation, Winbond International Corporation, Winbond Electronics Corporation America, Marketplace Management Limited, Nuvoton Investment Holding Ltd., Songyong Investment Co., Ltd.; CEO of Winbond Electronics Corporation; Manager, Goldbond LLC; Independent Director, member of the Audit Committee, Nomination Committee and convener of the Compensation Committee at Taiwan Cement Corp.

Work Experience: Former Chairman of Walsin Lihwa Corporation

Education: University of Washington Masters of Electrical Engineer and Business Administration

Other current positions: Chairman of Walsin Technology Corporation, Walton Advanced Engineering, Inc., HannStar Board Corp., Global Brands Manufacture, Prosperity Dielectrics Co., Ltd., Info-Tek Corp., Silitech Technology Corporation, Inpaq Technology Co., Ltd.; Vice Chairman of Career Technology Mfg. Co., Ltd.

Work Experience: Former Vice President of Walsin Lihwa Corporation

Education: Golden Gate University, Master of Business Administration

Other current positions: Chairman of HannStar Display Corporation, Hannshine Investment Corporation, Hanns Prosper Investment Corporation, Huali Investment Corp.; Director of Coretronic Corporation, HannsTouch Holdings Company, Bradford Ltd., HannSpirit (BVI) Holding Ltd., Brightpro Resources Limited, and Hannspree International Holdings Ltd.; Supervisor of Torch Investment Co., Ltd.

Work Experience: Director / President of Walsin Lihwa Corporation; Supervisor of Winbond Electronics Corporation; Director of HannStar Board Corp.; Chairman of HannsTouch Holdings Company.

Education: Doctorate of Business Administration, City University of Hong Kong and Doctorate of Business Administration, Certificate of Completion, Fudan University in Shanghai

Other current positions: Vice President of Phu My Hung International Corporation; Chief Representative of Central Trading & Development Corporation (Samoa)

Work Experience: Head of Political Section, Ministry of Foreign Affairs Representative Office in the United States; Deputy Representative of the Ministry of Foreign Affairs Representative Office in Canada; Director of the Ministry of Foreign Affairs Office in New York; Representative of the Ministry of Foreign Affairs in India; Political Deputy Minister of the Ministry of Foreign Affairs; Representative of the Ministry of Foreign Affairs in Indonesia; Deputy Minister of the Ministry of National Defense; Chairman of the Mainland Affairs Council, Executive Yuan

Education: Department of Law, Fu-Jen Catholic University; Master’s Degree in Diplomacy, National Chengchi University; MLitt in Law, University of Oxford (UK)

Other current positions: Partner at Li-Ren Law Firm; Director & Legal Advisor at Taifu Startup Association; Director at Yanxing Association.

Work Experience: CEO at Liang & Partners Law Offices; Arbitrator at the Chinese Arbitration Association, Taipei; Honorary Attorney appointed by the Small and Medium Enterprise Administration, Ministry of Economic Affairs; Director at Kerry TJ Logistics Company Limited;Director at Taiwan TAICON CORPORATION.

Education: Bachelor of Law, National Chung Hsing University; Master of Finance, National Taiwan University; Fine Arts, National Taiwan Normal University.

Other current positions: Director of Tung Hua Book Co., Ltd.; Independent Director of TTY Biopharm and Lite-On Technology Corporation.

Work Experience: PwC Taiwan Director; Executive Director, Taiwan Corporate Governance Association; Adjunct Professor, School of Science and Technology Management, National Tsing Hua University; Adjunct Professor, School of Management, National Taiwan University of Science and Technology, and Independent Director of Yuanta Financial Holdings &Yuanta Commercial Bank.

Education: Soochow University, Master in Accountancy; Bloomsburg University of Pennsylvania, Master of Business Administration

Other current positions: Managing Director of O-Bank

Work Experience: Managing Director, Central Trust of China; Director, Mega International Commercial Bank; Director, Economic Energy and Agriculture Department, Executive Yuan; Deputy Chairman, Council of Agriculture; Chairman, Central Animal Products Association, Animal Science and Technology Research Institute, Joint Credit Information Center, and Taiwan Cooperative Securities Co., Ltd.

Education: MBA, Graduate School of Business, National Taiwan University

Other current positions: Policy Advisor of Taiwan Electrical and Electronics Manufacturers’ Association; Senior Advisor of Taiwan Transportation Vehicle Manufacturers Association and the Chinese National Federation of Industries; Independent Director of USI Corporation, and Macronix International Co., Ltd. ; Member of Taoyuan Industrial Commercial Development & Investment Promotion Committee; Vice Chairman of ShaCode Foundation; Director of Fair Winds Foundation.

Work Experience: Director General of the Industrial Development Bureau of the Ministry of Economic Affairs; Minister of the Ministry of Economic Affairs; Chairman of the National Development Council; Vice Premier of the Executive Yuan; CEO of Taoyuan Industrial Commercial Development & Investment Promotion Committee; Director of Shinfox Energy Co., Ltd.; Independent Director of China Development Financial Holding Corporation & CDIB Capital Group

Education: Ph.D., Institute of Forestry, National Taiwan University

Other current positions: Chuanzhi Shared-Office Accounting Firm; Chairman of KS&A Investment Co. Ltd.; Independent Director of Mercuries F&B

Work Experience: Vice President of KPMG Taiwan Inc.; Executive Director of KMPG Taiwan; Head of Insurance Business of KMPG Taiwan; CPA & Counselor of Audit Department of KMPG Taiwan; Director & CFO of Maxpro Capital Acquisition Corp; Independent Director of KGI Life Insurance Co., Ltd.

Education: Ph.D. in Accounting, Business School, Renmin University of China, Master of Business Administration, Baruch College, City University of New York, Computer Auditing Joint Course Diploma, NYU/Coopers & Lybrand, Bachelor of Accounting, Department of Business, National Taiwan University

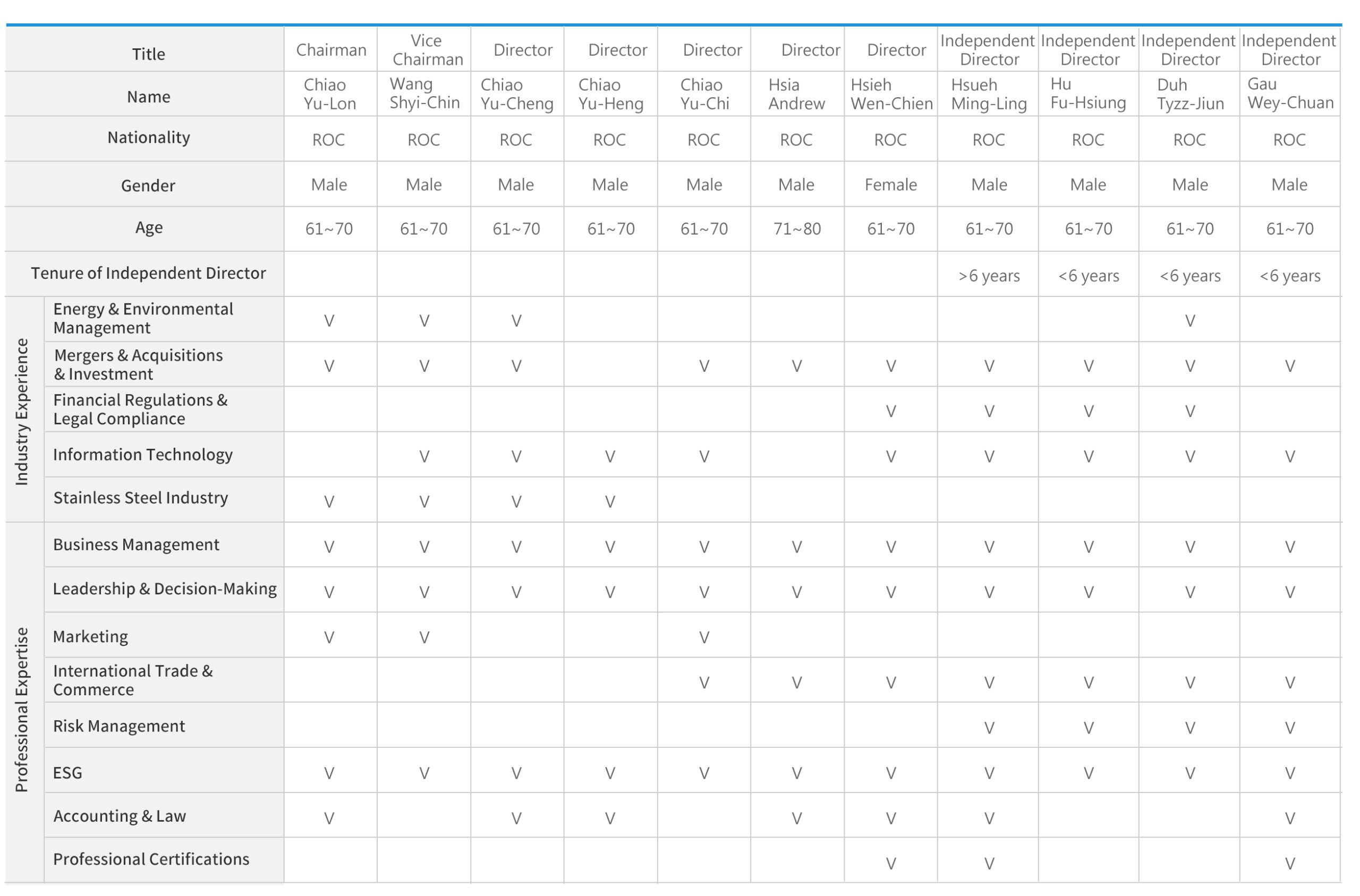

Board Competencies and Diversification

Pursuant to Article 20 of the Corporate Governance Best Practice Principles of Walsin Lihwa, the composition of the board of directors shall be determined by taking diversity into consideration, All members of the board shall have the knowledge, skills, and experience necessary to perform their duties. To achieve the ideal goal of corporate governance, the board of director shall possess the following abilities:

1. Ability to make operational judgements

2. Ability to perform accounting and financial analysis

3. Ability to conduct management administration

4. Ability to conduct crisis management

5. Knowledge of the industry

6. An international market perspective

7. Leadership

8. Ability to make policy decisions

Board diversity is a key principle in Walsin Lihwa’s Corporate Governance Best Practice Principles. The board of directors comprises industry experts and professionals from diverse fields, alongside shareholder-elected members. It consists of 11 directors, including 4 independent directors. In terms of age distribution, 8 directors are over 65 years old, while 3 are between 55 and 64 years old.

Our company is committed to strengthening its expertise in wire and cable, stainless steel, resources, and commercial real estate, striving to set a benchmark in the manufacturing industry. Our board of directors comprises seasoned professionals with diverse backgrounds, enhancing strategic decision-making and corporate governance. Chairman Chiao Yu-Lon has deep industry experience and an open leadership style that fosters collaboration and innovation. Directors Chiao Yu-Cheng, Chiao Yu-Heng, and Chiao Yu-Chi, having served in the management team, excel in operational management and investment strategy. Director Andrew Hsia, with a diplomatic background, brings international insights and expertise in Southeast Asian markets, while Director Wang Shyi-Chin, a steel industry expert, drives the company’s global expansion in stainless steel. To uphold our commitment to board diversity, Director Hsieh Wen-Chien, elected in 2024, contributes specialized knowledge in mergers and acquisitions, intellectual property, and technology services. Our independent directors further strengthen governance—Hsueh Ming-Ling and Gau Wey-Chuan, both certified accountants, provide expertise in finance, accounting, and corporate governance; Hu Fu-Hsiung offers insights into economic administration, financial securities, and credit information; Duh Tyzz-Jiun is well-versed in industrial operations and economic trends; and Gau Wey-Chuan brings proficiency in accounting, auditing, and information technology. Collectively, our board members provide visionary leadership, driving the company’s continued growth and strategic global positioning.

We emphasize board diversity and strong corporate governance. While the Corporate Governance Best Practice Principles require a minimum of 3 independent directors, we have appointed 4, representing 36% of the board, demonstrating our commitment to excellence in governance. Going forward, priority will be given to selecting female board members to ensure that women make up at least one-third of the board.

We appoint industry experts to our board of directors, leveraging their expertise in investment, accounting, finance, and corporate governance to support our core business initiatives. Their diverse backgrounds and experiences enhance decision-making and strategic synergy. Moving forward, we will continue to invite highly qualified candidates, aligning with our development strategies and adapting to internal and external changes to further strengthen board diversity.

The diverse professional specialties of the board of directors are provided as below:

Planning for Succession of Directors and Senior Managerial Officers and Succession Implementation

- Planning for Succession of Directors and Succession Implementation

A. For the effectiveness of board diversity, sustainable development, as well as independence and professional qualifications as prescribed in the Regulations Governing Appointment of Independent Directors and Compliance Matters for Public Companies, Walsin Lihwa factors in the following principles when nominating director candidates:

a. No discrimination of candidates’ ages, genders, ethnicities, and/or nationalities

b. Elites with expertise and rich experience in various domains that meet the needs of the company’s diversified development

c. Knowledge, skills, and experience necessary to perform their duties:

1. Operational judgements

2. Accounting and financial analysis

3. Management and administration

4. Risk management

5. Crisis management

6. Knowledge of the industry

7. An international market perspective

8. Leadership

9. Decision-making

B. Walsin Lihwa’s Regulations Governing Board Performance Evaluation takes comprehensive consideration of board performance evaluation results, directors’ participation in company operations, as well as their contribution to the company and their responsibilities to confirm the effectiveness of board functioning as a reference for selection of its directors. Moreover, pursuant to the Directions for the Implementation of Continuing Education for Directors and Supervisors of TWSE Listed and TPEx Listed Companies, Walsin Lihwa provides ongoing education to its directors to further improve their outstanding characteristics and decision-making effectiveness. In 2024, all directors of the board of Walsin Lihwa complied with the Regulations Governing Board Performance Evaluation and their ongoing education also proceeded well.

- Planning for Succession of Senior Managerial Officers and Succession Implementation

A. The selection, development, and succession of senior managerial officers, critical to business sustainability, are planned as follows:

a. Selection principle: Consistency with the core values of Walsin Lihwa, i.e., business integrity, a down-to-earth attitude toward business, pursuit of excellence, and emphasis on scientific approaches

b. Succession planning: Management training programs, enhancement of competencies for new technology, and job rotation based on successor candidates’ development potentials to focus on training resources relevant to company and departmental objectives to strengthen such candidates’ competitiveness in their current jobs

c. Development objective: Visionary leadership development through purposeful, systematic, and well-organized learning by doing to establish the most up-to-date management languages, help optimize the organizational culture at Walsin Lihwa, and lay a solid foundation for sustainable management

B. How Walsin Lihwa develops possible successor candidates at present:

a. The president, vice presidents, and other senior managerial officers invited to sit in at quarterly board and operation meetings to help strengthen their decision-making and judgement competencies

b. Successor candidates’ performance evaluation results as a reference for the selection of qualified successors

c. Two annual sessions of education and training for senior managerial officers above the divisional director level to cover performance management, leadership, economic and industry knowledge, and business sustainability to help them keep pace with the latest management thinking and stay on top of relevant contemporary issues through exchange and sharing with external lecturers and trainers

Pursuant to Article 14 of its Articles of Association, Walsin Lihwa shall have 9 to 11 directors of the board including at least 3 independent directors, and the number of directors of the board shall be determined by the board, Elections of directors of the board shall abide by the candidate nomination system as prescribed in Article 192-1 of the Company Act, and shareholders shall elect directors from among the nominees listed in the roster of director candidates. The acceptance and public announcement of the nomination of candidates for directors of the board shall be governed by the Company Act, Securities and Exchange Act, and other relevant laws and regulations.

Pursuant to Article 14-4 of the Securities and Exchange Act, Walsin Lihwa has established its Audit Committee in lieu of a supervisor. The Audit Committee consists of all the independent directors of the board to have the Company Act, Securities and Exchange Act, other relevant laws and regulations, and statutory supervision power executed.

Reelection of Directors and Independent Directors in 2023

The 19th term of office of directors and independent directors of Walsin Lihwa expired in 2023, and the 20th term of office was elected pursuant to Article 14 of the Articles of Association at the shareholders’ meeting on May 19, 2023. The newly elected 11 directors including 4 independent directors have a term of office for 3 years, effective upon being elected, from May 19, 2023 through May 18, 2026.

The reelection adopted the candidate nomination system as prescribed in Article 192-1 of the Company Act for shareholders to elect directors from among the nominees listed in the roster of director candidates. The number of director and independent director candidates, candidates’ names, as well as their qualifications, professionalism, independence, and concurrent positions were passed by the board on February 24, 2023 and announced accordingly.

- Appointment and Qualifications

Pursuant to Article 192-1 of the Company Act, Walsin Lihwa expressly stipulated in its shareholders’ meeting notice on March 2, 2023 that any shareholder holding 1% or more of the total number of outstanding shares issued by the company may submit to the company in writing a roster of director and independent candidates during the nomination period.

- Notice of Nomination of Director and Independent Director Candidates on March 2, 2023

| Announcement | |

|---|---|

| Number of directors to be elected | 11 directors including 4 independent directors (the number of director and independent director candidates nominated shall not exceed the quota of the directors and independent directors to be elected and the director and independent director candidates nominated shall be legally qualified) |

| Nomination period | March 6 to 16, 2023 |

| Address | Shareholders Service Office, Walsin Lihwa Address: 8F, 398, Xingshang Road, Neihu District, Taipei Tel: 02-2790-5885 |

| Shareholders’ meeting for review of nomination | March 31, 2023 |

| Information required for review | The shareholders nominating director and independent director candidates should provide their names, shareholder account numbers (or identity card numbers or tax ID numbers), share certificates, and/or why anyone is nominated if the nominee has been be an independent director of Walsin Lihwa for 3 consecutive terms of office. Nominees should provide their personal data, independent director declarations, and statuses of concurrent positions as prescribed by Article 2 to Article 5 of the Regulations Governing Appointment of Independent Directors and Compliance Matters for Public Companies. |

| Others | Nil |

- Professional Qualification Requirements for Independent Directors

| Mr. Hsueh, Ming-ling | Mr. Hu, Fu-hsiung | Mr. Duh, Tyzz-Jiun | Mr. Gau, Wey-Chuan | |

|---|---|---|---|---|

| I. An independent director shall meet one of the following professional qualification requirements, together with at least five years’ work experience: | ||||

| 1. An instructor or higher in a department of commerce, law, finance, accounting, or other academic department related to the business needs of the company in a public or private junior college, college, or university; | O | O | ||

| 2. A judge, public prosecutor, attorney, certified public accountant, or other professional or technical specialist who has passed a national examination and been awarded a certificate in a profession necessary for the business of the company; and |

O | O | ||

| 3. Work experience in the area of commerce, law, finance, or accounting, or otherwise necessary for the business of the company. | O | O | O | O |

| II. A person to whom any of the following circumstances applies may not serve as an independent director: | ||||

| 1. Any of the circumstances in the subparagraphs of Article 30 of the Company Act, and | O | O | O | O |

| 2. Elected in the capacity of the government, a juristic person, or a representative thereof, as provided in Article 27 of the Company Act. | O | O | O | O |

| III. During the two years before being elected or during the term of office, an independent director may not have been or be any of the following: | ||||

| 1. An employee of the company or any of its affiliates, | O | O | O | O |

| 2. A director or supervisor of the company or any of its affiliates, | O | O | O | O |

| 3. A natural-person shareholder who holds shares, together with those held by the person’s spouse, minor children, or held by the person under others’ names, in an aggregate of one percent or more of the total number of issued shares of the company or ranking in the top 10 in holdings, |

O | O | O | O |

| 4. A spouse, relative within the second degree of kinship, or lineal relative within the third degree of kinship, of a managerial officer under subparagraph 1 or any of the persons in the preceding two subparagraphs, | O | O | O | O |

| 5. A director, supervisor, or employee of a corporate shareholder that directly holds five percent or more of the total number of issued shares of the company, or that ranks among the top five in shareholdings, or that designates its representative to serve as a director or supervisor of the company under Article 27, paragraph 1 or 2 of the Company Act, |

O | O | O | O |

| 6. If a majority of the company’s director seats or voting shares and those of any other company are controlled by the same person: a director, supervisor, or employee of that other company, | O | O | O | O |

| 7. If the chairperson, general manager, or person holding an equivalent position of the company and a person in any of those positions at another company or institution are the same person or are spouses: a director (or governor), supervisor, or employee of that other company or institution, |

O | O | O | O |

| 8. A director, supervisor, officer, or shareholder holding five percent or more of the shares, of a specified company or institution, as noted in the following (1) – (4), that has a financial or business relationship with the company: |

O | O | O | O |

| (1) It holds 20 percent or more and no more than 50 percent of the total number of issued shares of the company; | O | O | O | O |

| (2) It holds shares, together with those held by any of its directors, supervisors, and shareholders holding more than 10 percent of the total number of shares, in an aggregate total of 30 percent or more of the total number of issued shares of the public company, and there is a record of financial or business transactions between it and the public company. The shareholdings of any of the aforesaid persons include the shares held by the spouse or any minor child of the person or by the person under others’ names; |

O | O | O | O |

| (3) It and its group companies are the source of 30 percent or more of the operating revenue of the company; and | O | O | O | O |

| (4) It and its group companies are the source of 50 percent or more of the total volume or total purchase amount of principal raw materials (those that account for 30 percent or more of total procurement costs, and are indispensable and key raw materials in product manufacturing) or principal products (those accounting for 30 percent or more of total operating revenue) of the company. |

O | O | O | O |

| 9. The preceding restrictions do not apply to a professional individual who, or an owner, partner, director, supervisor, or officer of a sole proprietorship, partnership, company, or institution that, provides auditing services to the company or any affiliate of the company, or that provides commercial, legal, financial, accounting or related services to the company or any affiliate of the company for which the provider in the past 2 years has received cumulative compensation exceeding NT$500,000, or a spouse thereof; provided, this restriction does not apply to a member of the remuneration committee, public tender offer review committee, or special committee for merger/consolidation and acquisition, who exercises powers pursuant to the Regulations Governing Appointment of Independent Directors and Compliance Matters for Public Companies or to the Business Mergers and Acquisitions Act or related laws or regulations. |

O | O | O | O |

| IV. No independent director of the company may concurrently serve as an independent director of more than three other public companies. | O | O | O | O |

| V. Pursuant to the Company Act andRegulations Governing Appointment of Independent Directors and Compliance Matters for Public Companies,there are 2 independent directors andnot less than one-fifth of the director seats are held by independent directors. |

O | O | O | O |

- Nomination Process and Candidate Data

From March 6 to 16, 2023, any shareholder holding 1% or more of the total number of outstanding shares issued by the company could submit to the company in writing a roster of director and independent director candidates. As of March 16, 2023, no shareholder submitted any roaster. On February 24, 2023 when the board nominated director and independent director candidates, the independent director candidates already met the qualification requirements for professionalism, independence, and concurrent serving restrictions as prescribed by the Regulations Governing Appointment of Independent Directors and Compliance Matters for Public Companies and they were accordingly announced.

- Election and Appointment

On May 19, 2023, the shareholders’ meeting reelected directors and independent directors by disclosed cumulative voting and the votes for directors and independent directors were separately counted pursuant to the company’s Methods of Election of Directors of the Board. The term of office of the new board is 3 year from May 19, 2023 through May 18, 2026.

| Meeting Date | Important Resolution |

|---|---|

| 2026/1/23 | 1. Approval of the change of the president. 2. Approval of lifting the non-competition restriction on managerial officers. 3. Approval of a 77.69 million euros capital increase at Luxembourg subsidiary Walsin Lihwa Europe S.a r.l., a wholly owned subsidiary. 4. Approval of a donation of NT$22,200,000 to the Walsin Lihwa Sustainability Foundation. |

| Meeting Date | Important Resolution |

|---|---|

| 2025/11/7 | 1.Approval of the consolidated financial statements for the 3rd quarter of 2025. 2.Approval of a US$ 15,000 thousand capital increase at Concord Industries Limited, a wholly owned subsidiary. |

| 2025/8/8 | 1.Approval of the consolidated financial statements of the 2nd quarter of 2025. 2.Approval of a donation of NT$6,500,000 to the Walsin Lihwa Sustainability Foundation. |

| 2025/5/9 | Approval of the consolidated financial statements of the 1st quarter of 2025. |

| 2025/2/21 | 1.Approval of the 2024 consolidated financial report. 2.Approval of the earnings distribution plan for the fiscal year 2024, with a proposed cash dividend of NT$0.5 per share. 3.The 2025 Annual Shareholders’ Meeting is scheduled to be held at 9 a.m. on May 16, 2025, at the multifunction conference hall, 1F, 15, Lane 168, Xingshan Road, Neihu District, Taipei. |

| Meeting Date | Important Resolution |

|---|---|

| 2024/11/8 | 1.Approval of the consolidated financial statements of the 3rd quarter of 2024. 2.Approval of a capital increase of approximately USD 9.15 million, through the Singapore subsidiary Walsin Singapore Pte. Ltd., to PT. Walsin Everising Specialty Steel Indonesia for the establishment of a stainless steel wire rod plant in Indonesia. |

| 2024/8/2 | 1.Approval of the consolidated financial statements of the 2nd quarter of 2024. 2.Approval to participate in the cash capital increase in Winbond Electronics Corp. with a total amount not exceeding NT$3 billion. 3.Approval to donate and establish the Walsin Lihwa Sustainability Foundation. |

| 2024/5/3 | 1.Approval of the consolidated financial statements of the 1st quarter of 2024. 2.Approval of a US$160,000 thousand capital increase at Walsin Singapore Pte., a wholly owned subsidiary. |

| 2024/3/29 | 1.Approval of a US$ 35,000 thousand capital increase at Concord Industries Limited, a wholly owned subsidiary. 2.Approval of the disposal of 20% equity of Innovation West Mantewe Pte. Ltd. in Singapore for a total amount of US$ 58,652 thousand. |

| 2024/3/11 | The BOD resolved to convene 2024 annual shareholders’ meeting. (Adding new cause) |

| 2024/2/23 | 1.Approval of the 2023 consolidated financial report. 2.Approval of the earnings distribution plan for the fiscal year 2023, with a proposed cash dividend of NT$1.1 per share. 3.The 2024 Annual Shareholders’ Meeting is scheduled to be held at 9 a.m. on May 17, 2024, at the multifunction conference hall, 1F, 15, Lane 168, Xingshan Road, Neihu District, Taipei. 4.Approval of the total amount will not exceed NT$ 5 billion to issue corporate bond. |

| 2024/2/19 | Approval of subsidiary Cogne Acciai Speciali S.p.A. acquiring 100% equity of Mannesmann Stainless Tubes GmbH (Germany), with the total amount not exceeding EUR 135 million. |

| 2024/1/26 | Approval of subsidiary Cogne Acciai Speciali S.p.A. acquiring 65% equity of Com.Steel Inox S.p.A.(Italy), with the total amount not exceeding EUR 28 million. |

| Meeting Date | Important Resolution |

|---|---|

| 2023/11/3 | 1.Approval of the consolidated financial statements of the 3rd quarter of 2023. 2.Approval to participate in the cash capital increase in Winbond Electronics Corp. with a total amount not exceeding NT$1.2 billion. |

| 2023/8/11 | 1.Approval of the consolidated financial statements of the 2nd quarter of 2023. 2.Resolved to dispose of 29.5% equity of PT. Westrong Metal Industry in Indonesia for a total amount of USD 146 million. 3.Resolved to acquire 75% equity of Berg Holding Limited in Hong Kong for a total amount of USD 119 million. (As a result of this acquisition, Walsin Singapore Pte. Ltd. holds a total of 79.61% of PT. Sunny Metal Industry’s stock.) |

| 2023/5/29 | Approved to issue common shares for cash to sponsor the issuance of GDR, with a tentative issuance range of 240,000 thousand to 300,000 thousand common shares. |

| 2023/5/5 | 1.Approval of the consolidated financial statements of the 1st quarter of 2023. 2.Approval of subsidiary Cogne Acciai Speciali S.p.A. acquiring 100% equity of Special Melted Products Ltd., with a transaction amount was approximately GBP 144 million. 3.Approval of the total amount will not exceed EUR 140 million to inject capital to Cogne Acciai Speciali S.p.A. via Luxembourg subsidiaries. 4.Approval of represented subsidiary WALSIN ENERGY CABLE SYSTEM CO., LTD. to announcement the acquisition of right-of-use assets of land from related party. |

| 2023/3/24 | 1.The BOD resolved to convene 2023 annual shareholders’ meeting. (Adding new cause) 2.Approval of the total amount will not exceed 300 million new common shares to sponsor issuance of GDR and/or issue new common shares via book building. 3.Approval of a US$45,000,000 capital increase at Walsin Singapore Pte., a wholly owned subsidiary. |

| 2023/2/24 | 1.Approval of the 2022 business report. 2.Approval of the 2022 earnings distribution plan to pay NT$1.8 in cash per share. 3.A regular shareholders’ meeting at 9 a.m. on May 19, 2023 at the multifunction conference hall, 1F, 15, Lane 168, Xingshan Road, Neihu District, Taipei. 4.Approval of the total amount will not exceed NT$10 billion to issue corporate bond. 5.Approval of the company and its subsidiary Walsin Energy Cable System Co., Ltd., to sign Joint Venture Agreement, Technology Consultancy Agreement and Technology Licence Agreement with Sweden’s NKT HV Cables AB, and the company to participate the capital increase in cash of its subsidiary Walsin Energy Cable System Co., Ltd. with total amount of NT$2.7 billion. 6.Approval of represented subsidiary Borrego Energy, LLC to announce the disposal of its business of the solar PV and energy storage procurement platform division, with a transaction amount was approximately US$35 million. |

| Meeting Date | Important Resolution |

|---|---|

| 2022/11/4 | 1.Approval of the consolidated financial statements of the 3rd quarter of 2022. 2.Approval of a US$300,000,000 capital Increase at Walsin Singapore Pte., a wholly owned subsidiary. 3.Resolved to terminate the trading of Global Depositary Receipts(GDRs) on the London Stock Exchange. |

| 2022/8/5 | 1.Approval of the consolidated financial statements of the 2nd quarter of 2022. 2.Resolved to acquire 29.5% equity of PT. Westrong Metal Industry in Indonesia for the total amount of USD 146 million. 3.Resolved to loan to subsidiary PT. Sunny Metal Industry for NT$5,223,290,000. |

| 2022/5/31 | 1.Resolved to acquire 70% equity of Cogne Acciai Speciali S.p.A. in Italy for the total amount of EUR 225 million. 2.Resolved to acquire 40% equity of Innovation West Mantewe Pte. Ltd. (hereinafter referred to as IWM) in Singapore for the total amount of US$ 80 million, IWM holds 45% equity of PT. Transcoal Minergy (an Indonesian company). |

| 2022/5/24 | 1.Resolved to the disposal of land to Hwa Bao Botanic Conservation Corp., implementing the project to conserve and collect of native plant resources, and to cultivate the capability of conservation native plant resources. 2.Resolved to spin off and sell the development business of the Company’s U.S. subsidiary, Borrego Solar Systems, Inc. to ECP , for restructuring the Company’s business strategy of green energy. |

| 2022/5/6 | Approval of the consolidated financial statements of the 1st quarter of 2022. |

| 2022/4/11 | Resolved to acquire 50.1% equity of PT. Sunny Metal Industry in Indonesia for the total amount of US$ 200 million. |

| 2022/3/18 | 1.The BOD resolved to convene 2022 annual shareholders’ meeting(method of convening the meeting: hybrid shareholders’ meeting) and adding new cause. 2.Approval of the acquisition of right-of-use assets of land for the term of 20 years located at intercontinental container terminal project phase 1 back line A6-A at port of Kaohsiung. 3.Approval of the total amount will not exceed NT$10 billion to issue corporate bond. |

| 2022/2/22 | 1. Approval of the 2021 business report. 2.Approval of the 2021 earnings distribution plan to pay NT$1.6 in cash per share. 3.A regular shareholders’ meeting at 9 a.m. on May 13, 2022 at the multifunction conference hall, 1F, 15, Lane 168, Xingshan Road, Neihu District, Taipei. |

| Meeting Date | Important Resolution |

|---|---|

| 2021/12/13 | Approval of the cash capital increase and tentative number of common shares to be issued is 300,000,000 shares. |

| 2021/11/05 | Approval of the financial statements of the 3rd quarter of 2021. |

| 2021/08/06 | 1.Approval of the financial statements of the 1st half of 2021. 2.Approval of the total amount will not exceed NT$10 billion to issue unsecured corporate bond. |

| 2021/06/25 | 1.A regular shareholders’ meeting has been rescheduled at 9:00 a.m., July 15, 2021 at 1F, 15, Lane 168, Xingshan Road, Neihu District, Taipei City. 2.Approval of the total transaction amount will not exceed USD178,500 thousand to acquire 100% equity of New Hono Investment Pte. Ltd. |

| 2021/05/07 | Approval of the financial statements of the 1st quarter of 2021. |

| 2021/02/26 | 1.2020 business report presentation 2.Passage of the 2020 earning distribution plan to pay NT$0.9 in cash per share 3.A regular shareholders’ meeting scheduled at 9:00 a.m., May 28, 2021 at 1F, 15, Lane 168, Xingshan Road, Neihu District, Taipei City 4.Passage of secured ordinary corporate bond issuance up to NT$8 billion。 |

| 2021/01/22 | 1.Passage of an appointment of a new Corporate Governance Director 2.Passage of an acquisition of ordinary shares up to NT$1.8 billion from TECO Electric & Machinery Co., Ltd. |

| Meeting Date | Important Resolution |

|---|---|

| 2020/11/20 | Approval of a capital increase by offering 205,332,690 new shares in exchange for 171,103,730 ordinary shares from TECO Electric & Machinery Co. — a ratio of 1: 0.8333 — for the two companies to strengthen strategic cooperation. |

| 2020/11/13 | 1.Report of the financial statements of the 3rd quarter of 2020. 2.Approval of a buyback of 60,000,000 shares as treasury stock for a capital reduction with the capital reduction record date scheduled on November 16, 2020. 3.Approval of a US$54,000,000 capital reduction at Walsin Specialty Steel Holdings Ltd., an important subsidiary. 4.Approval of a capital expenditure budget for an expected investment of NT$4.3 billion in smart manufacturing facilities for power cable production and warehouse automation. |

| 2020/08/04 | 1.Approval of the financial statements of the 1st half of 2020. 2.Approval of appointment of members of the 4th term of office of the Remuneration Committee. 3.Approval of a financial executive reshuffle. 4.Approval of a buyback of 40,000,000 shares as treasury stock for a capital reduction with the capital reduction record date scheduled on August 5, 2020. 5.Approval of the 25th treasury stock buyback from August 5 through October 4, 2020 for a buyback of 60 million shares on the open market with the buyback price ceiling at NT$17.5 per share. |

| 2020/05/29 | Approval of the election and appointment of the chairman of the board |

| 2020/04/10 | 1.Approval of a Chief Marketing Officer reshuffle. 2.Approval of additions to the regular shareholders’ meeting agenda on May 29, 2020. 3.Approval of the 24th treasury stock buyback from April 13 through June 12, 2020 for a buyback of 40 million shares on the open market with the buyback price ceiling at NT$16.5. |

| 2020/02/27 | 1.Approval of the 2019 business report. 2.Approval of the 2019 earnings distribution plan to pay NT$0.5 in cash per share. 3.A regular shareholders’ meeting at 9 a.m. on May 29, 2020 at the multifunction conference hall, 1F, 15, Lane 168, Xingshan Road, Neihu District, Taipei. 4.Approval of an audit executive reshuffle. 5.Approval of an acquisition of ordinary shares from HannStar at no higher than NT$540 million. |

| 2020/01/10 | 1.Approval of the establishment of PT Walsin Nickel Industrial Indonesia to set up nickel pig iron and power plants in the Morowali Industrial Park. 2.Approval of a loan of NT$7,495,000,000 provided to PT Walsin Nickel Industrial Indonesia. 3.Approval of a US$178,500,000 corporate bond acquisition from Golden Harbour International Pte. Ltd. |

| Meeting Date | Important Resolution |

|---|---|

| 2019/11/01 | 1.Report of the financial statements of the 1st 3 quarters of 2019. 2.Approval of selling part of the land and buildings of the Yangmei plant to Prosperity Dielectrics. /td> |

| 2019/06/12 | 1.Approval of appointment of a new President. 2.Approval of a financial executive reshuffle. 3.Approval of installation of a governance director. |

| 2019/05/24 | 1.Approval of a sale of 94.3% of the company’s shareholdings in Nanjing Walsin Metal Co. Ltd. to Gree Electric Appliances Inc. of Zhuhai through two subsidiaries, Renowned International Limited and Walsin China Investment Co., Ltd. 2.Approval of Renowned International Limited’s capital reduction to return the payment of RMB$161,374,000 for share subscription and proceed with liquidation. 3.Approval of Renowned International Limited’s capital reduction to return the payment of US$70,917,455 for share subscription. |

| 2019/05/06 | Report of the financial statements of the 1st quarter of 2019. |

| 2019/02/22 | 1.Approval of the 2018 business report. 2.Approval of the 2018 earnings distribution plan to pay NT$1.2 in cash per share. 3.A regular shareholders’ meeting at 9 a.m. on May 24, 2019 at the multifunction conference hall, 1F, 15, Lane 168, Xingshan Road, Neihu District, Taipei. |

| Meeting Date | Important Resolution |

|---|---|

| 2018/08/02 | 1.Report of the financial statement of the 1st half of 2018. 2.Approval of a buyback of 40,000,000 shares as treasury stock for a capital reduction with the capital reduction record date scheduled on August 6, 2018. |

| 2018/05/04 | 1.Report of the financial statements of the 1st quarter of 2018. 2.Approval of Walsin Specialty Steel Holdings Ltd.’s US$100 million capital increase. |

| 2018/02/23 | 1.Approval of the 2017 business report. 2.Approval of the 2017 earnings distribution plan to pay NT$1 in cash per share. 3.A regular shareholders’ meeting at 9 a.m. on May 25, 2018 at the multifunction conference hall, 1F, 15, Lane 168, Xingshan Road, Neihu District, Taipei. 4.Approval of participation in Powertec Energy’s seasoned equity offering to subscribe to 34,027,000 shares totaling NT$340 million. |

| Meeting Date | Important Resolution |

|---|---|

| 2017/11/03 | 1.Report of the financial statements of the 1st 3 quarters of 2017. 2.Approval of participation in Winbond’s seasoned equity offering to subscribe to 72,521,000 shares totaling NT$1.6 billion. |

| 2017/08/04 | 1.Report of the financial statements of the 1st half of 2017. 2.Approval of appointment of the Chief Information Officer and the Chief Technology Officer. |

| 2017/05/26 | 1.Approval of establishment of the Audit Committee. 2.Approval of appointment of the members of the 3rd term of office of the Remuneration Committee. |

| 2017/05/05 | 1.Report of the financial statements of the 1st quarter of 2017. 2.Approval of a buyback of 30,000,000 shares as treasury stock for a capital reduction with the capital reduction record date scheduled on May 5, 2017. |

| 2017/02/17 | 1.Approval of the 2016 business report. 2.Approval of the 2016 earnings distribution plan to pay NT$0.7 in cash per share. 3.A regular shareholders’ meeting at 9 a.m. on May 26, 2017 at the multifunction conference hall, 1F, 15, Lane 168, Xingshan Road, Neihu District, Taipei. 4.Approval of participation in Powertec Energy’s seasoned equity offering to subscribe to its shares up to NT$693 million. |

| 2017/01/13 | 1.Approval of lifting the non-competition restriction on managerial officers. 2.Approval of Walsin Specialty Steel Holdings Ltd.’s capital reduction to return the payment of US$4,400,000 for share subscription. 3.Approval of donation to the HannStar Foundation — a juridical person — to help promote cultural and education events as well as the culture and creative industries. |

| Meeting Date | Important Resolution |

|---|---|

| 2016/10/28 | 1.Report of the financial statements of the 1st 3 quarters of 2016. 2.Approval of company organization adjustment that the chairman of board does not concurrently serve as CEO. 3.Approval of appointment of independent director Hsueh, Ming-Ling as a member on the Remuneration Committee. 4.Approval of Walsin Lihwa Holdings Ltd.’s capital reduction to return the payment of US$225 million for share subscription. 5.Approval of a buyback of 120,000,000 shares as treasury stock for a capital reduction with the capital reduction record date scheduled on November 1, 2016. |

| 2016/07/29 | 1.Report of the financial statements of the 1st half of 2016. 2.Approval of lifting the non-competition restriction on managerial officers. 3.Approval of a buyback of 60,000,000 shares as treasury stock for a capital reduction with the capital reduction record date scheduled on August 1, 2016. 4.Approval of a buyback of 120,000,000 shares as treasury stock to maintain company credit and shareholder interests. 5.Approval of cash dividend distribution for 2015 with the ex-dividend day (shares bought not entitled to dividend payout) scheduled on October 18, 2016, the ex-dividend record day on October 24, 2016, and the dividend payout date on November 11, 2016. |

| 2016/04/29 | 1.Report of the financial statements of the 1st quarter of 2016. 2.Approval of Walsin (Nanjing) Development Co., Ltd.‘s mall and office complex construction in the AB block of Walsin Centro. 3.Approval of a buyback of 60,000,000 shares as treasury stock. |

| 2016/02/26 | 1.Approval of the 2015financial statements. 2.Resolution of a cash dividend payment of NT$0.2 per share. 3.A regular shareholders’ meeting at 9 a.m. on May 25, 2016 at the multifunction conference hall, 1F, 15, Lane 168, Xingshan Road, Neihu District, Taipei. |

| Meeting Date | Important Resolution |

|---|---|

| 2015/10/28 | 1.Report of the financial statements of the 3rd quarter of 2015. 2.Approval of the Business Integrity Committee’s 2015 implementation results and work planning for 2016. 3.Report of achievements in corporate social responsibility promotion in 2015. |

| 2015/07/29 | 1.Report of the financial statements of the 1st half of 2015. 2.Implementation of Walsin Specialty Steel Holdings Ltd.’s capital reduction out of overall financial planning. |

| 2015/06/17 | Approval of a buyback of 40,000,000 shares as treasury stock transferred to employees. |

| 2015/04/29 | Report of the financial statements of the 1st quarter of 2015. |

| 2015/04/01 | Resolution of implementation of Walsin Lihwa Holdings Ltd.’s US$420 million seasoned equity offering for working capital enhancement. |

| 2015/02/17 | 1.Approval of the 2014 financial statements. 2.A regular shareholders’ meeting at 9 a.m., May 27, 2015 at Grand Victoria Hotel Taipei. 3.Resolution of no dividend payout. |

| 2015/01/14 | 1.Approval of lifting the non-competition restriction on managerial officers. 2.Shares of NT$498 million in Walsin Lippo Industries acquired from Walsin Lihwa Holdings Ltd. for investment structure streamlining. 3.Implementation of inter-subsidiary financing to strengthen financial management effectiveness. |

| Meeting Date | Important Resolution |

|---|---|

| 2014/10/29 | 1.Report of the financial statements of the 3rd quarter of 2014. 2.Shares of up to RMB$340 million in Hangzhou Walsin Power Cable & Wire Co., Ltd. acquired through Walsin China Investment Co., Ltd., a newly established overseas holding subsidiary. 3.Proposed divestment of 50 million ordinary shares in Winbond at no lower than NT$9 per share from November 1, 2014 through April 30, 2015. |

Pursuant to the Regulations Governing Board Performance Evaluation of Walsin Lihwa, the Company conducts an annual evaluation of board performance. Additionally, an evaluation is carried out by an external independent professional institution or a panel of external experts and scholars at least once every three years. The evaluation for each year is conducted at the end of the year.

In 2018, 2021, and 2024, the Company engaged the Taiwan Corporate Governance Association, an independent third party with no business dealings with the Company, to assess five key aspects of board performance. These aspects include the board’s composition and division of duties, guidance and oversight, delegation and governance, effective communication and collaboration, as well as self-discipline and continuous self-improvement. The assessment involved interviews and questionnaire surveys.

The external evaluations, coupled with feedback and recommendations from the professional organization, provide the Company with objective and professional insights to enhance board effectiveness.

The 2025 board performance evaluation was completed in December 2025, with the results presented at a board meeting on January 23, 2026. For more information, please refer to the attached file available on the Traditional Chinese version of our webpage.

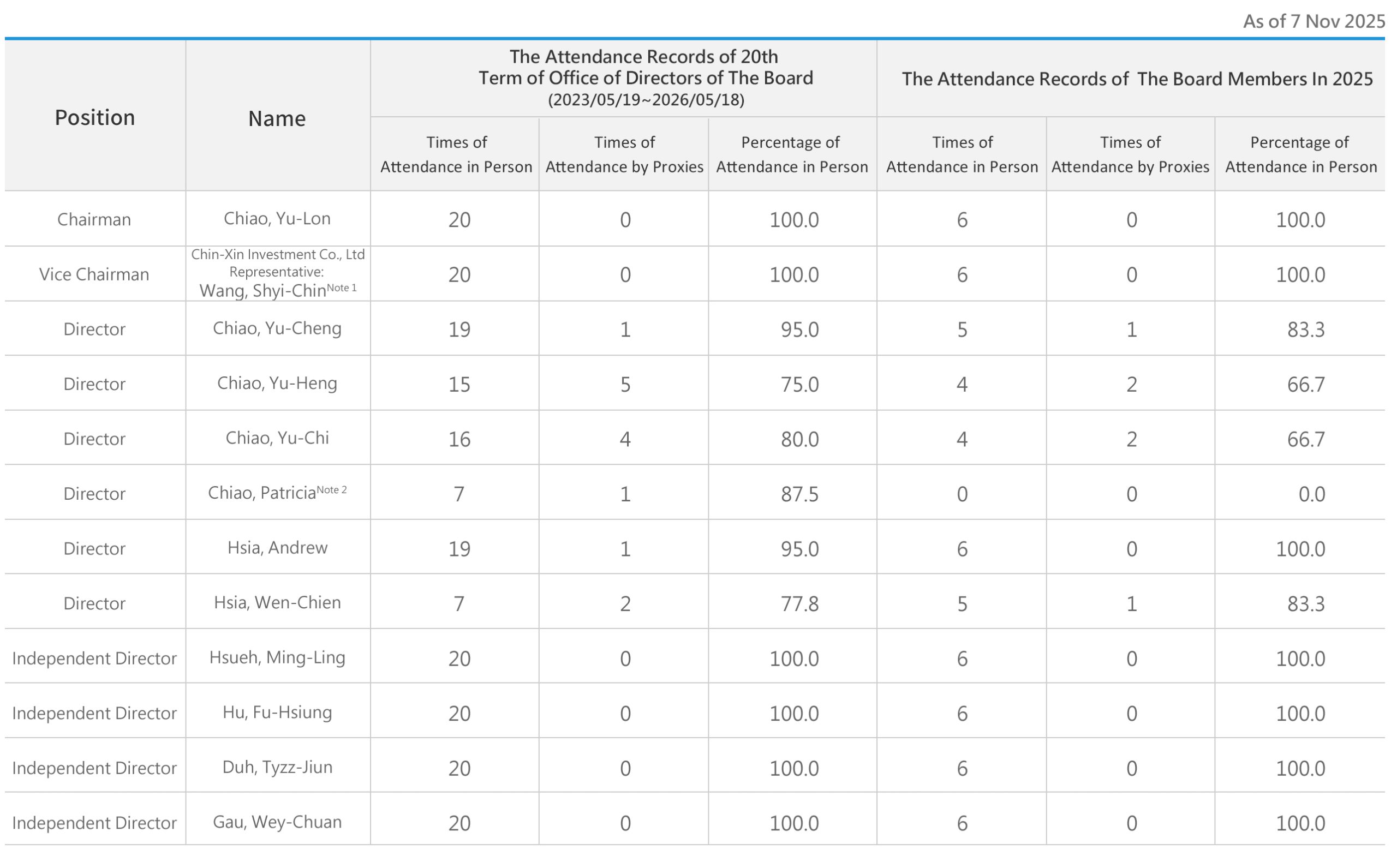

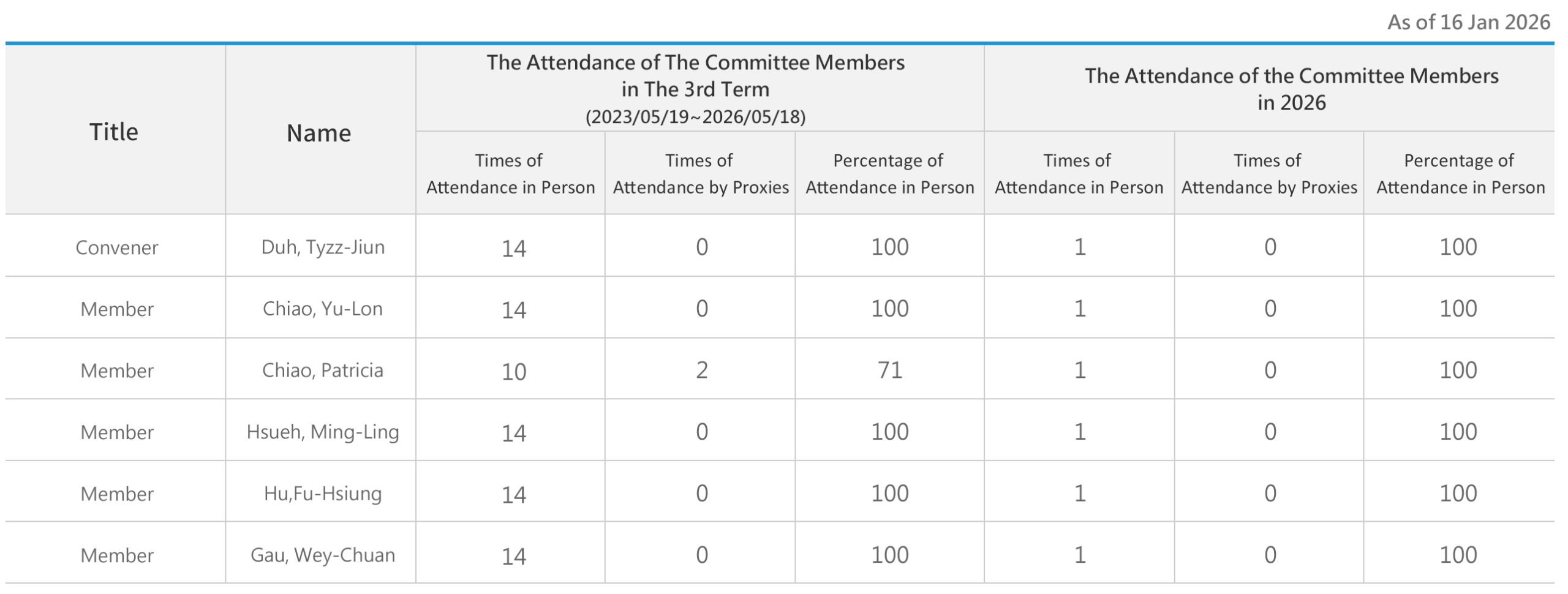

- The Attendance Records of the Board Members

During the 20th term of office of directors of the board from May 19, 2023 through May 18, 2026, 20 board meetings were convened and the attendance to the meetings follows:

Note 1: The corporate director Chin-Xin Investment Corp. made a change in representative on Oct. 21, 2024, replacing Ku, Li-Chin with Wang, Shyi-Chin.

Note 2: Vice Chairman Ms. Chiao, Patricia resigned on March 11, 2024.

- Communication between Walsin Lihwa’s Independent Directors and Chief Audit Executive in 2025

- Communication between Walsin Lihwa’s Independent Directors and Chief Audit Executive in 2024

- Communication between Walsin Lihwa’s Independent Directors and Chief Audit Executive in 2023

- Communication between Walsin Lihwa’s Independent Directors and Chief Audit Executive in 2022

- Communication between Walsin Lihwa’s Independent Directors and Chief Audit Executive in 2021

- Communication between Walsin Lihwa’s Independent Directors and Chief Audit Executive in 2020

- Communication between Walsin Lihwa’s Independent Directors and Chief Audit Executive in 2019

- Communication between Walsin Lihwa’s Independent Directors and Chief Audit Executive in 2018

- Communication between Walsin Lihwa’s Independent Directors and Chief Audit Executive in 2017

- Communication between CPAs and Walsin Lihwa’s Independent Director in 2025

- Communication between CPAs and Walsin Lihwa’s Independent Director in 2024

- Communication between CPAs and Walsin Lihwa’s Independent Director in 2023

- Communication between CPAs and Walsin Lihwa’s Independent Director in 2022

- Communication between CPAs and Walsin Lihwa’s Independent Director in 2021

- Communication between CPAs and Walsin Lihwa’s Independent Director in 2020

- Communication between CPAs and Walsin Lihwa’s Independent Director in 2019

- Communication between CPAs and Walsin Lihwa’s Independent Director in 2018

- Communication between CPAs and Walsin Lihwa’s Independent Director in 2017

Function Committee

- Committee members

- Compensation Committee

- Audit Committee

- Sustainable Development Committee

- Nomination Committee

Convener ○

Member●

| Committee members | Specialism | Audit Committee | Compensation Committee | Sustainable Development Committee | Nomination Committee |

|---|---|---|---|---|---|

| Chiao, Yu-Lon Chairman | Business leadership and management | ● | ● | ||

| Hsueh, Ming-Ling Independent Director |

Accounting and corporate governance | ● | ○ | ● | ● |

| Hu, Fu-Hsiung Independent Director |

Finance and technology | ○ | ● | ● | ● |

| Duh, Tyzz-Jiun Independent Director |

Industry management and Green Energy | ● | ● | ○ | ● |

| Gau, Wey-Chuan Independent Director |

Finance, law and technology | ● | ● | ● | ○ |

| Chiao, Patricia | Friendly workplace and social care | ● | |||

| Lo, Huei-Ping Vice President |

Corporate Governance and financial accounting | Chief Sustainability Officer |

To strengthen corporate governance, ensure a sound system for compensation management of the Board of Directors, and protect the rights and interests of shareholders, in September 2011, the Board of Directors approved the Compensation Committee Charter which is pursuant to Article 14-6-1 of the Securities and Exchange Act as well as the Regulations Governing the Appointment and Exercise of Powers by the Compensation Committee of a Company Whose Stock is Listed on the Stock Exchange or Traded Over the Counter promulgated by the Financial Supervisory Commission on March 18, 2011. The Board of Directors also approved to establish the Compensation Committee on September 27, 2011.

Duties of the committee

The Compensation Committee assists the Board in discharging its responsibilities related to execute and evaluate the compensation programs of Walsin Lihwa’s directors of the Board and executives.

1.Regularly review the Compensation Committee organic regulations and provide amendment recommendations.

2.Develop the criteria for evaluating the performance of the directors of the board and senior management, and regularly review such criteria as well as the annual performance objectives for the directors of the board and senior management and the company compensation standard, structure, system, and policy.

3.Regularly review to which extent the directors of the board and senior management achieve their performance objectives to decide what should be included in their compensation and the monetary values of their compensation based on the performance review results.

Committee members

The Committee consists of 4 members appointed by resolution of the board of directors. Currently, the fourth term Compensation Committee is comprised of all four independent directors; whose term is from May 19, 2023 to the tenure expired date of the 20th term board of directors of Walsin Lihwa Corp.

Committee operation

The operation of the Compensation Committee is in accordance with the company’s Compensation Committee Charter. The Committee meets at least two times a year.

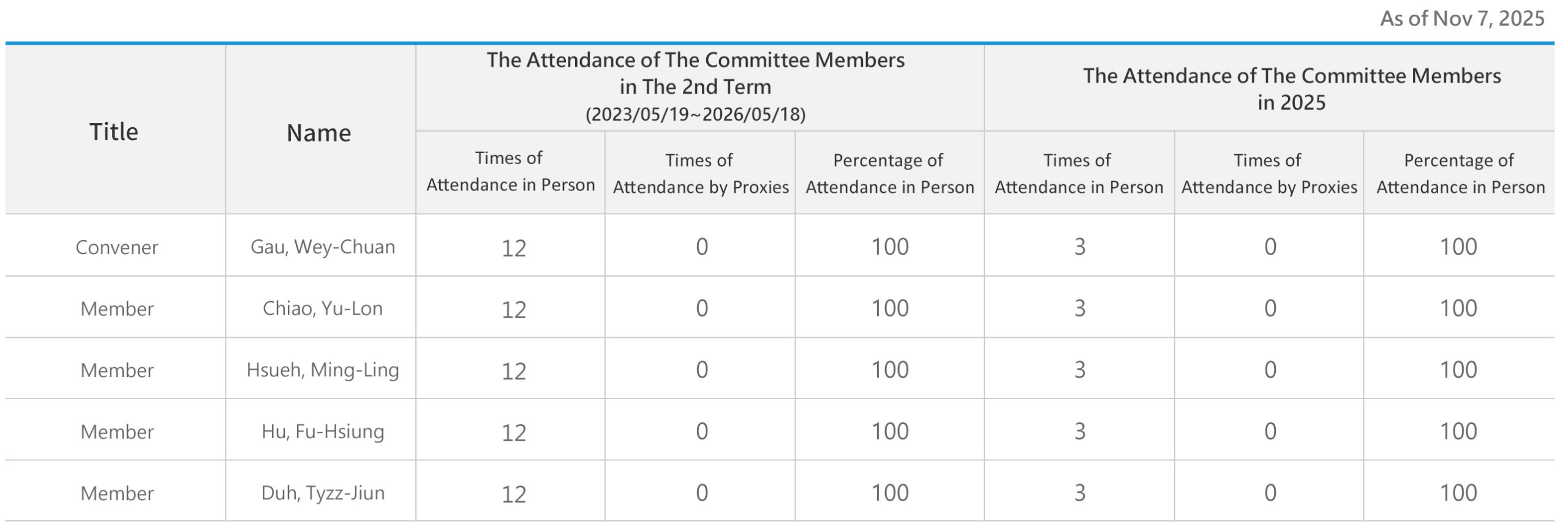

The 5th term of office of the Compensation Committee from May 19, 2023 through May 18, 2026 convened 8 meetings, and the attendance of the committee members is provided as below.

| Title | Name | The attendance of the committee members in the 5th term |

The attendance of the committee members in 2025 |

||||

|---|---|---|---|---|---|---|---|

| Times of Attendance in Person |

Times of Attendance by Proxies |

Percentage of Attendance in Person |

Times of Attendance in Person |

Times of Attendance by Proxies |

Percentage of Attendance in Person |

||

| Convener | Hsueh, Ming-Ling | 8 | 0 | 100 | 3 | 0 | 100 |

| Member | Hu, Fu-Hsiung | 8 | 0 | 100 | 3 | 0 | 100 |

| Member | Tyzz-Jiun Duh | 8 | 0 | 100 | 3 | 0 | 100 |

| Member | Wey-Chuan Gau | 8 | 0 | 100 | 3 | 0 | 100 |

Please refer to our annual reports and the Market Observation Post System of the Taiwan Stock Exchange for details of the meetings convened and attendance of individual members on the committee.

Compensation Committee Meeting Agenda and Resolution in 2025

Compensation Committee Meeting Agenda and Resolution in 2024

Compensation Committee Meeting Agenda and Resolution in 2023

Compensation Committee Meeting Agenda and Resolution in 2022

Compensation Committee Meeting Agenda and Resolution in 2021

Compensation Committee Meeting Agenda and Resolution in 2020

Walsin Lihwa (the “Company”) established the Audit Committee (the “Committee”) consisting of independent directors pursuant to Article 14-4 of the Securities and Exchange Act, and established the Audit Committee Charter pursuant to the Article of the Regulations Governing the Exercise of Powers by Audit Committees of Public Companies on May 26, 2017.

Duties of the committee

The powers of the Committee are as follows:

1. The adoption of or amendments to the internal control system pursuant to Article 14-1 of the Securities and Exchange Act.

2. Assessment of the effectiveness of the internal control system.

3. The adoption or amendment, pursuant to Article 36-1 of the Securities and Exchange Act, of the procedures for handling financial or business activities of a material nature, such as acquisition or disposal of assets, derivatives trading, loaning of funds to others, and endorsements or guarantees for others.

4. Matters in which a director is an interested party.

5. Asset transactions or derivatives trading of a material nature.

6. Loans of funds, endorsements, or provision of guarantees of a material nature.

7. The offering, issuance, or private placement of equity-type securities.

8. The hiring or dismissal of a certified public accountant, or their compensation.

9. The appointment or discharge of a financial, accounting, or internal audit officer.

10. Financial reports which are signed or sealed by the chairperson, managerial officer, and accounting officer.

11. Other material matters as may be required by the Company or by the competent authority.

Annual Foci

1. Agenda arrangement (for Audit Committee meetings and communication meetings)

2. Handling matters related to the meeting of the Audit Committee in accordance with the law (meeting notice, proceedings)

3. Follow-ups and execution of improvements requested by the Audit Committee

4. Providing company information required by independent directors to assist them in fully exercising their powers

5. Annual self-assessment of the Audit Committee

6. Establishing and revising the organizational regulations and relevant operating procedures

7. Announcement of relevant matters concerning the Audit Committee pursuant to law (organizational regulations and operational status)

8. Whether any employee, manager and director has entered into related-party transactions and possible conflicts of interest in such transactions

9. Suggestions and complaints from interested parties

10. Management of exchange rate risks

11. Information Security

12. Work safety/environmental protection and legal compliance

Committee operation

The operation of the Audit Committee is in accordance with the Company’s Audit Committee Charter. The Committee shall convene at least once quarterly.

| Title | Name | The attendance of the committee members in the 3th term |

The attendance of the committee members in 2025 |

||||

|---|---|---|---|---|---|---|---|

| Times of Attendance in Person |

Times of Attendance by Proxies |

Percentage of Attendance in Person |

Times of Attendance in Person |

Times of Attendance by Proxies |

Percentage of Attendance in Person |

||

| Convener | Hu, Fu-Hsiung | 19 | 0 | 100 | 7 | 0 | 100 |

| Member | Hsueh, Ming-Ling | 19 | 0 | 100 | 7 | 0 | 100 |

| Member | Duh,Tyzz-Jiun | 19 | 0 | 100 | 7 | 0 | 100 |

| Member | Gau,Wey-Chuan | 19 | 0 | 100 | 7 | 0 | 100 |

Please refer to our annual reports and the Market Observation Post System of the Taiwan Stock Exchange for details of the meetings convened and attendance of individual members on the committee.

The resolution of the Audit Committee in 2025

The resolution of the Audit Committee in 2024

The resolution of the Audit Committee in 2023

The resolution of the Audit Committee in 2022

The resolution of the Audit Committee in 2021

The resolution of the Audit Committee in 2020

The Sustainable Development Committee was established pursuant to a resolution at the 17th meeting convened by the 18th term of the Board of Directors on November 1, 2019, when the Sustainable Development Committee Charter was also stipulated. The Committee consists of 4 to 7 members. At least half of the members shall be independent directors and the Committee convener shall be elected among the members themselves. The Committee in its current term of office has 6 members. The Committee’s organization structure and duties are provided as below:

Committee Duties

As the highest level of the sustainability organization within Walsin, it is a functional committee led by an Independent Director serving as the Convener. This committee is responsible for formulating

policies, strategies, objectives, or management guidelines related to corporate sustainability. It also reviews the annual plans of various promotion centers, supervises and tracks the execution

progress, outcomes, and related matters of these centers, and reports regularly to the Board of Directors. At the same time, it focuses on major issues of concern to interested parties, oversees

communication plans, and approves the content of the sustainability report. In addition, in accordance with the corporate risk management framework, it identifies risks and opportunities

related to sustainability and regularly monitor and control various significant risks.

Five centers under the committee with respective responsibilities

| Business Integrity | It is responsible for formulating and promoting policies and systems related to ethical management, integrating integrity and ethical values into the Company’s business strategies, supervising and reporting the execution results, and evaluating the effectiveness of the preventive measures established to implement ethical management. |

| Environment, healthy, and safety | It is responsible for formulating our environmental protection (including green energy and sustainable ecology and environment), safety, health, energy and carbon management policies and action plans, collaborating with the Human Resources Department to implement measures to protect mothers from illegal abuse, and overseeing and reporting on the implementation performance. It carries out the interdepartmental integration and implementation promotion on related issues above. |

| Green operation | It is responsible for formulating the green operation strategy, promoting circular economy, optimizing green manufacturing processes, exploring green produces and services with future value, and overseeing and reporting on the implementation performance. It carries out the interdepartmental integration and implementation promotion on related issues above. |

| Customer service and supplier management | It is responsible for formulating policies and implementation plans for the improvement of customer service quality and supplier management, overseeing and reporting on the implementation performance. It carries out the interdepartmental integration and implementation promotion on related issues. |

| Employee Relations and Social Engagement | It is responsible for promoting and building a safe and healthy working environment for employees to fully utilize their talents for reasonable compensation and benefits. It also promotes and deepen the Company’s influence in the field of public welfare by actively participating in four major aspects, i.e., corporate citizens, caring for minorities, environmental protection and cultivation, and strengthening community relationships, so as to pay back to society with concrete, continuous action. |

| Sustainability Office | The committee is tasked with managing meeting affairs, formulating and compiling the structure of the annual sustainability report, identifying sustainability issues that require attention, and developing corresponding action plans. It also assists in the planning and execution of sustainability development strategies, liaises, coordinates, and integrates operations related to various promotion centers, and manages and tracks the performance of sustainability issues across all aspects, while establishing continuous improvement plans, and reporting execution results and work plans to the committee. |

Organizational structure of the committee

Committee Operation

The establishment of the Sustainable Development Committee is intended to further strengthen sustainable development, corporate governance, and the board of directors’ commitment to business integrity. The operation of the committee shall abide by the Sustainable Development Committee Charter of Walsin Lihwa, and the committee shall convene at least twice annually to review the annual plans of the five centers under the committee as well as their plan implementation results to report to the board of directors in the following year.

The Board of Directors receives regular reports on operations, finance, corporate governance, sustainability issues, etc. every year. Through the diverse experience of its members, the Board offers broad and professional opinions to assist the Company in making appropriate decisions and guiding the Company in a clear strategic direction. In 2025, five meetings of the Sustainable Development Committee were held, with the agenda as follows:

(1) Financial Supervisory Commission (FSC) Sustainable Development Path Planning

(2) Tracking of Current Year Implementation Plans

(3) Reporting on Current Year’s Implementation Plan Results and Next Year’s Implementation Plans

(4) Materiality Analysis Results and Sustainability Report

(5) IFRS Sustainability Disclosure Standards

The progress for the first half of 2025 was reported to the Board of Directors on July 31, 2025, and the execution results for 2025 and 2026 implementation plan were approved by resolution of the Board of Directors on January 23, 2026.

The 3rd term of office of the Sustainable Development Committee from May 19, 2023 through May 18, 2026 convened 14 meetings, and the attendance of the committee members is provided as below.

Status of Business Integrity Promotion

The 2024 status was reported to the board of directors on January 6,2025. And the report details are tabulated as attached:

Status of Business Integrity Promotion in 2024

The 2023 status was reported to the board of directors on January 26,2024. And the report details are tabulated as attached:

Status of Business Integrity Promotion in 2023

The 2022 status was reported to the board of directors on January 10,2023. And the report details are tabulated as attached:

Status of Business Integrity Promotion in 2022

The 2021 status was reported to the board of directors on January 11,2022. And the report details are tabulated as attached:

Status of Business Integrity Promotion in 2021

The Business Integrity Center reported its 2019 and 2020 implementation statuses to the board of directors respectively on January 11, 2020 and January 22, 2021. For details, please refer to the appendix at the end of the webpage.

Introduction of Business Integrity Promotion and Annual Implementation Status

Communication with Stakeholders

The year 2019 witnessed the beginning of the status on communication with stakeholders reported to the board of directors every year.

The 2024 status was reported to the board of directors on May 3, and the report details are tabulated as below.

Report on Communication with Stakeholders in 2024

The 2023 status was reported to the board of directors on May 5, and the report details are tabulated as below.

Report on Communication with Stakeholders in 2023

The 2022 status was reported to the board of directors on November 4, and the report details are tabulated as below.

Report on Communication with Stakeholders in 2022

The 2021 status was reported to the board of directors on November 5, and the report details are tabulated as below.

Report on Communication with Stakeholders in 2021

The 2020 status was reported to the board of directors on November 13, and the report details are tabulated as below.

Report on Communication with Stakeholders in 2020

The 2019 status was reported to the board of directors on November 1, and the report details are tabulated as below.

Report on Communication with Stakeholders in 2019

To optimize board functions, strengthen management mechanisms, and live up to the vision for sound corporate governance, the Nomination Committee Charter is enacted pursuant to Article 27-3 of the Corporate Governance Best Practice Principles jointly adopted by the Taiwan Stock Exchange and Taipei Exchange as well as Article 27 of the Walsin Lihwa Corporation Corporate Governance Best Practice Principles. On August 6, 2021, the 10th meeting convened by the 19th term of office of the Board of Directors decided to establish the Nomination Committee (hereafter referred to as the Committee) and enacted the Committee’s charter.

Duties of the committee

Authorized by the Board of Directors, the Committee shall exercise the due care of a good administrator to faithfully fulfill its duties and responsibilities prescribed as below and submit its nominations to the Board of Directors for discussion and consideration.

1. Set up the criteria for the professional knowledge, competencies, experiences, genders, independence, and diverse backgrounds required for the Board of Directors and managerial officers to seek, review, and nominate the candidates for the Board of Directors and managerial officers.

2. Establish individual function committee structures and review the enactment of and amendment to individual function committees’ charters.

3. Develop plans of ongoing education for the Board of Directors and succession of managerial officers, and review such plans on a regular basis.

4. Review corporate governance, board performance, and the enactment of and amendment to relevant regulations.

5. Implement the Board’s resolutions that the Committee is responsible for.

Committee members

The Committee shall consist of at least three Directors of the Board recommended by the Board of Directors and a majority of the Committee members shall consist of Independent Directors of the Board.

The 2nd term of office of the Committee consists of the Chairman of the Board and 4 Independent Directors of the Board, whose term of office started on May 19, 2023 and will last until the expiration of the 20th term of office of the Board of Directors.

Committee operation

The Committee operates according to Nomination Committee Charter and shall convene at least twice a year.

Please refer to our annual reports and the Market Observation Post System of the Taiwan Stock Exchange for details of the meetings convened and attendance of individual members on the committee.

Nomination Committee Meeting Agenda and Resolution in 2025

Nomination Committee Meeting Agenda and Resolution in 2024

Nomination Committee Meeting Agenda and Resolution in 2023

Nomination Committee Meeting Agenda and Resolution in 2022

Nomination Committee Meeting Agenda and Resolution in 2021

Major Internal Policies

Article of Incorporation and organization

- Articles of Incorporation

- Rules and Procedures of Shareholders' Meetings

- Methods of Election of Directors of the Board Walsin Lihwa

- Board of Directors Meeting Regulations

- Regulations Governing Board Performance Evaluation

- Audit Committee Charter

- Compensation Committee Charter

- Sustainable Development Committee Charter

- Nomination Committee Charter

Financial regulations

- Procedures for the Acquisition and Disposal of Assets

- Procedures for Lending Funds to Other Parties

- Endorsement and Guarantee Procedures

- Derivatives Trading Procedures

- Procedures for Governing Financial and Business Matters Between this Corporation and its Related Parties

Corporate governance regulations

- Corporate Governance Best Practice Principles

- Ethical Corporate Management Best Practice Principles

- Procedures for Ethical Management and Guidelines for Conduct

- Ethical Conduct Guidelines for Directors of the Board and Managerial Officers

- Ethical Conduct Guidelines for Employees

- Standard Operating Procedures for Processing Requests Made by the Directors of the Board

- Procedures for Handling Material Inside Information and Prevention of Insider Trading

- Guidelines for Suggestions and Complaints by Stakeholders

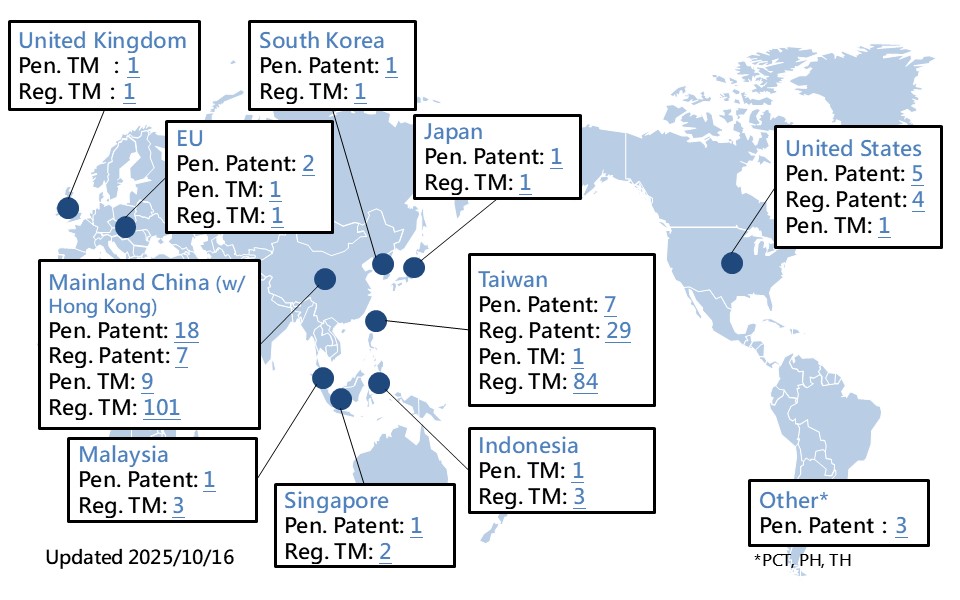

- Intellectual Property Right Management Manual

- Risk Management Policy and Procedures

- Sustainable Development Practice Principles

Internal Audit

Internal Audit Organization and Operation

The comprehensive internal audit system and Audit Committee of Walsin Lihwa help ensure effective internal control and report. The company’s internal audit procedures stipulate the power and responsibilities of its Auditing Office, audit requirements, and approval authority. All the business activities at Walsin Lihwa and its subsidiaries are subject to internal audits.

The Auditing Office– an independent unit with a chief audit executive and dedicated auditors — reports directly to the board of directors. Corporate Governance Best Practice Principles of the company stipulates that the appointments and removals of the dedicated auditors, assessment of their performance, and their compensation packages are reported by the chief audit executive to the chairman of the board for approval. The management of Walsin Lihwa values the Auditing Office, Audit Committee, and their auditors, which are adequately empowered to ensure ongoing and effective implementation of the internal audit system by rigorously checking and evaluating internal control shortcomings and operational effectiveness while assisting the board of directors and management in fulfilling their corporate governance duties.

The chief audit executive and independent directors of the board shall meet at least once quarterly to report the statuses of internal control and audit implementation to the Audit Committee. In case of major abnormalities, their meetings can be convened anytime. The Audit Committee convener can also discuss internal control implementation with the chief audit executive on an as-needed basis quarterly.

The board of directors reviews audit reports on a quarterly basis, and the chief audit executive reports to the chairman of the board, president, and Audit Committee on an as-needed basis in addition to regular reports to the board of directors.

Audit Planning and Implementation

At the end of every year, the Auditing Office shall decide the scope of auditing in the following year based on risk evaluation results. During its annual auditing, the Auditing Office shall also review the results of self-assessment of its internal control systems conducted by individual business units themselves to comprehensively evaluate the effectiveness of internal control design and implementation.

Major audits are implemented based on annual audit planning approved by the board of directors, and the board of directors may ask for ad-hoc audits when necessary to timely keep the management updated on existing or potential internal control issues. All the audit findings along with correction and/or prevention measures subsequently taken as well as improvements made are recorded for follow-ups and timely reported to the management.

Risk Management

- Risk Management Status

- Intellectual Property Right Management

- Information Security

- Promotion of Prevention of Insider Trading

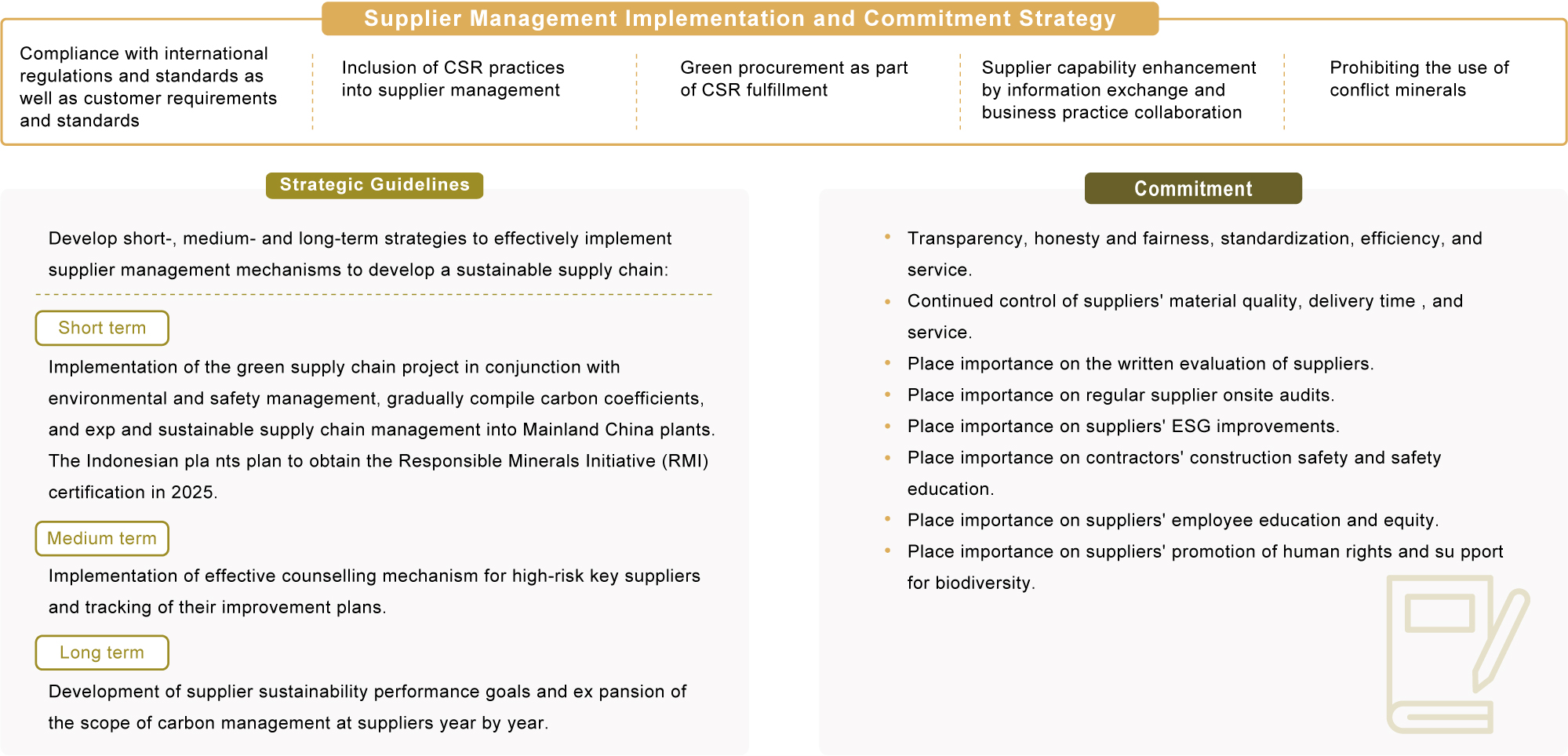

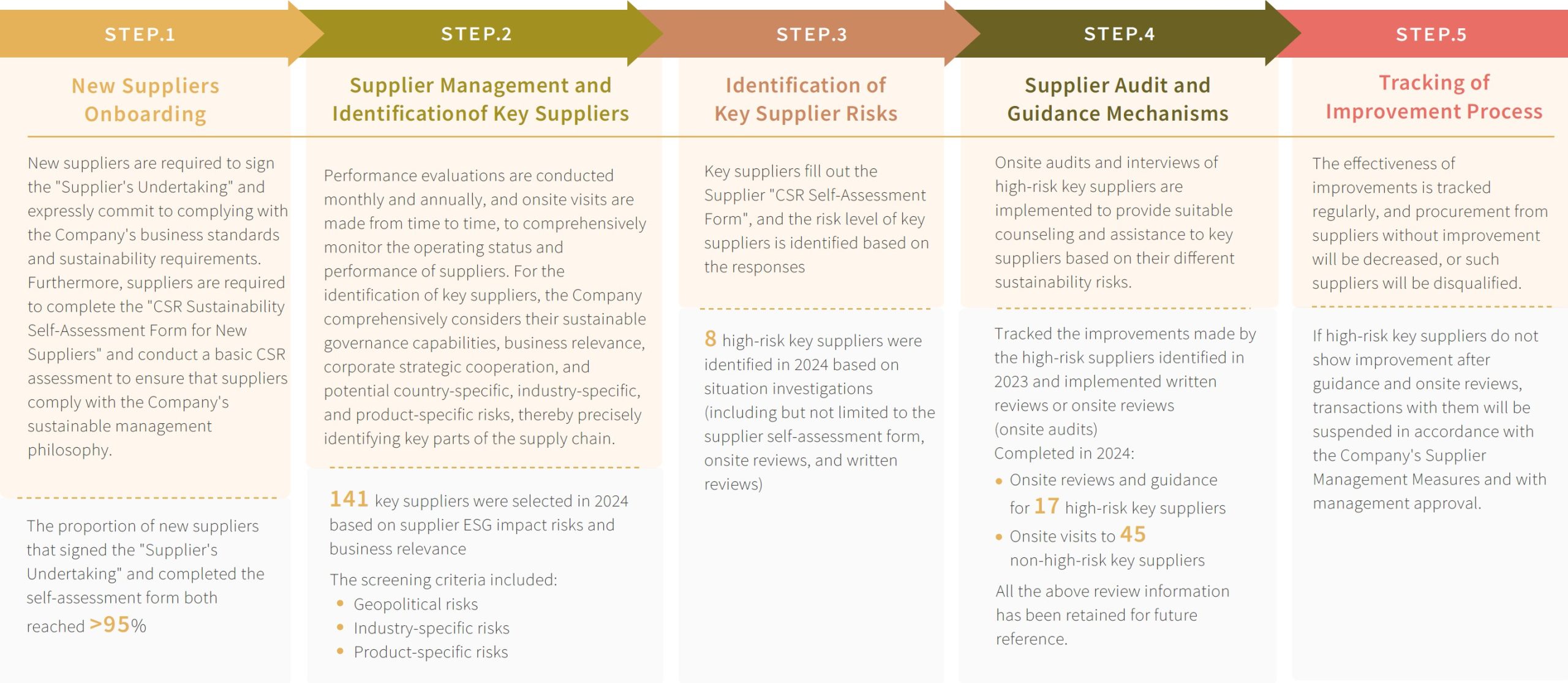

- Sustainable Supply Chain

- Stakeholder Rights and Interests